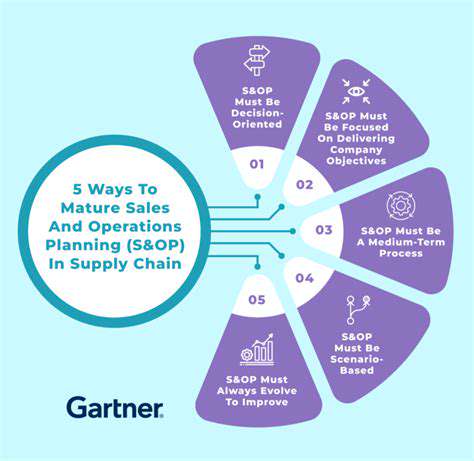

Effective strategies to combat the threat of financial fraud require a multi-pronged approach. This includes strengthening security measures, improving detection capabilities, and fostering collaboration between financial institutions, law enforcement agencies, and educational institutions. The implementation of sophisticated fraud detection systems and the development of robust security protocols are vital steps in preventing fraudulent activities.

Furthermore, promoting financial literacy through educational programs and awareness campaigns is crucial. Empowering individuals with the knowledge to identify and avoid fraudulent schemes is a cornerstone of a robust defense against financial fraud.

Leveraging Machine Learning for Enhanced Fraud Detection

Improving Accuracy and Efficiency

Machine learning algorithms are revolutionizing fraud detection by enabling a more accurate and efficient approach compared to traditional rule-based systems. These algorithms can analyze vast datasets of transactional data, identifying subtle patterns and anomalies indicative of fraudulent activities that might be missed by human analysts. This heightened accuracy translates to a significant reduction in false positives, allowing security teams to focus on genuine threats and avoid unnecessary investigations, ultimately saving valuable time and resources.

Furthermore, machine learning models can adapt and learn from new data, continuously improving their detection capabilities over time. This adaptive learning is crucial in a dynamic environment where fraudsters constantly evolve their tactics. By continuously updating the model with new data, the system remains resilient and effectively identifies emerging fraud patterns, ensuring a robust defense against evolving threats.

Real-time Fraud Detection and Prevention

One of the significant advantages of machine learning in fraud detection is the ability to analyze data in real-time. This capability allows for immediate identification and blocking of potentially fraudulent transactions, preventing financial losses before they occur. By rapidly processing data streams, machine learning models can flag suspicious activity as it happens, enabling swift intervention and minimizing the impact of fraudulent attempts.

This real-time analysis is particularly crucial in high-volume transactions, such as online shopping and financial transactions. Traditional fraud detection methods often lag behind, potentially allowing fraudulent activities to go undetected and cause significant financial damage. Machine learning's real-time capabilities mitigate these risks by providing immediate responses to suspicious activity, strengthening the overall security posture.

The ability to identify and flag potential fraudulent activities as they occur allows for proactive measures. This proactive approach is instrumental in minimizing the financial impact of fraud and safeguarding customer trust. In addition, real-time fraud detection can also improve customer experience by preventing unnecessary delays and complications during transactions.

By leveraging machine learning for real-time analysis, organizations can strengthen their fraud prevention strategies, significantly reducing financial losses and enhancing customer trust.

The integration of machine learning into fraud detection systems offers a dynamic and proactive approach to combat fraud. This proactive approach, coupled with the continuous learning capabilities of machine learning models, strengthens security measures against evolving fraud techniques. In essence, machine learning allows for a more agile and robust response to fraud, ensuring a high level of protection in today's dynamic digital landscape.

Beyond Transactional Analysis: AI's Role in Customer Behavior Monitoring

Beyond the Surface: Exploring Deeper Applications

Transactional Analysis (TA) provides a valuable framework for understanding interactions, but its limitations become apparent when dealing with complex, nuanced situations. AI, with its capacity for sophisticated pattern recognition and learning, can delve beyond the surface-level exchanges to uncover deeper meanings and motivations. This deeper analysis is crucial for understanding the intricate dynamics at play in human-human and human-machine interactions.

By analyzing vast datasets of interactions, AI can identify subtle patterns and predict future behaviors. This predictive capability transcends the simple transactional exchanges that TA focuses on, offering a more comprehensive understanding of the underlying motivations and drivers behind human actions.

The Role of Context in AI-Powered Understanding

AI excels at recognizing patterns within data, but true understanding requires context. Contextual awareness, something TA often struggles with, is crucial for interpreting the nuances of human behavior. AI models can be trained to consider factors like cultural background, emotional state, and even the physical environment to provide a more complete picture of the interaction.

Expanding the Scope of Understanding

AI can analyze data from various sources, such as text, audio, and video. This multi-modal approach allows for a broader understanding of human behavior, going beyond the limitations of verbal communication that TA often relies on. This expanded scope allows AI to identify and interpret subtle cues and gestures that might otherwise go unnoticed, leading to a more holistic perspective.

AI and Emotional Intelligence

AI can be trained to recognize and interpret emotions, a crucial aspect of human interaction often overlooked in traditional TA. This emotional intelligence allows AI to respond more empathetically and effectively, fostering more meaningful and productive interactions. Understanding and responding to the emotional undercurrents of a situation is vital for effective communication and problem-solving.

The Future of Human-Machine Interaction

AI's ability to analyze interactions beyond the transactional level opens up exciting possibilities for the future of human-machine interaction. Imagine AI-powered systems that can anticipate and respond to user needs with greater nuance and empathy, leading to more seamless and satisfying experiences. The incorporation of AI into various facets of our lives, from healthcare to customer service, promises a more responsive and personalized approach to interaction.

Ethical Considerations and Challenges

While AI holds immense potential, its application in understanding human behavior raises ethical concerns. Privacy concerns and the potential for misuse of sensitive data are critical considerations. Careful consideration of ethical implications and implementation strategies is essential to ensure responsible use of AI in this field. Furthermore, ensuring fairness and avoiding bias in AI algorithms is paramount to prevent discriminatory outcomes.

Real-Time Fraud Detection and Prevention: Staying Ahead of the Curve

Real-Time Fraud Detection Systems

Real-time fraud detection systems are crucial for businesses operating in the digital age, as they allow for the immediate identification and prevention of fraudulent activities. These systems analyze vast amounts of transaction data in real-time, enabling businesses to act quickly to stop potentially harmful transactions before they cause significant financial damage. Real-time analysis is key to minimizing losses and maintaining customer trust. The speed of these systems is a critical factor in their effectiveness.

Implementing a robust real-time fraud detection system requires a deep understanding of the specific risks and vulnerabilities of the business. Understanding the nuances of the transactions and the typical patterns of fraudulent behavior allows for the development of highly accurate algorithms. This allows for the swift identification of suspicious activities and the mitigation of potential losses.

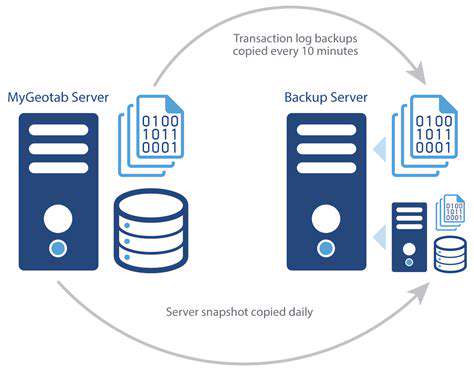

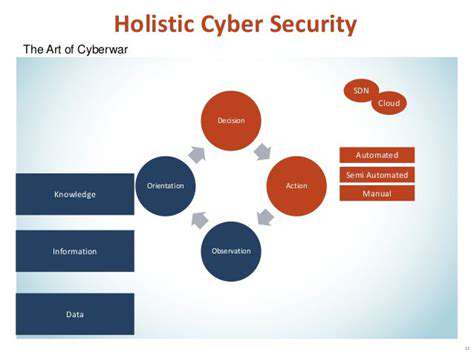

Key Components of a Real-Time System

A comprehensive real-time fraud detection system relies on several critical components. These include sophisticated algorithms that analyze data, advanced machine learning models to identify patterns, and a secure infrastructure for storing and processing large volumes of transaction data. These components work together to provide a robust system that can adapt to changing fraud strategies.

Data security is paramount in protecting sensitive transaction data and maintaining the confidentiality of customer information. A secure infrastructure is essential to prevent unauthorized access or modification of the data used for fraud detection.

Machine Learning and AI in Fraud Detection

Machine learning and artificial intelligence play a pivotal role in modern real-time fraud detection. These technologies can identify complex patterns and anomalies in transaction data that might be missed by traditional methods. By learning from vast datasets, AI algorithms can adapt to new fraud schemes and improve their accuracy over time.

Using AI algorithms for real-time fraud detection allows businesses to identify and block fraudulent transactions in milliseconds, significantly reducing losses and protecting customer accounts.

The Importance of Data Analysis

Thorough data analysis is essential for building effective real-time fraud detection systems. The system must analyze transaction data, user behavior, and other relevant factors to identify potential red flags and fraudulent activities. Accurate data analysis is the foundation of effective fraud prevention strategies.

Data analysis tools and techniques must be regularly updated and refined to keep pace with evolving fraud tactics. This adaptability ensures the system continues to be effective in preventing new and emerging fraudulent activities.

Scalability and Adaptability

Real-time fraud detection systems must be scalable to handle increasing transaction volumes and adaptable to changing fraud patterns. Scalability is essential to accommodate growing business needs and maintain system performance as the volume of transactions increases. The system should be able to seamlessly integrate with existing business systems and adapt to new technologies.

The ability of a fraud detection system to adapt to changing fraud patterns is crucial for its long-term effectiveness. A rigid system may quickly become outdated and ineffective as fraudsters devise new methods for exploiting vulnerabilities.

Integration with Existing Systems

Integrating the real-time fraud detection system with existing business systems is vital for smooth operation and efficient data flow. Seamless integration ensures that fraud detection data is readily available to relevant personnel, facilitating quick responses to potential threats. Effective integration is essential for minimizing disruption and maximizing system performance.

Careful planning and execution of the integration process are critical to avoid errors and ensure that the system seamlessly integrates with existing infrastructure and workflows.

Regulatory Compliance and Security

Compliance with relevant financial regulations is paramount in real-time fraud prevention. Strict adherence to regulatory requirements ensures the system operates ethically and transparently, maintaining the trust of customers and stakeholders. Understanding and adhering to specific regulatory standards is crucial for maintaining business operations.

Maintaining a high level of security is essential to protect sensitive customer data and prevent unauthorized access or misuse. This includes implementing robust security measures to safeguard both the system and the data it processes.